What do you learn in the fundamentals of accounting?

In today's business world, each industry has its language i.e., way of communicating. Accounting is the primary language of finance and related businesses. It helps business owners figure out financial situations by analysing important financial data. This information then turns the fundamentals of accounting into a comprehensive tangible report.

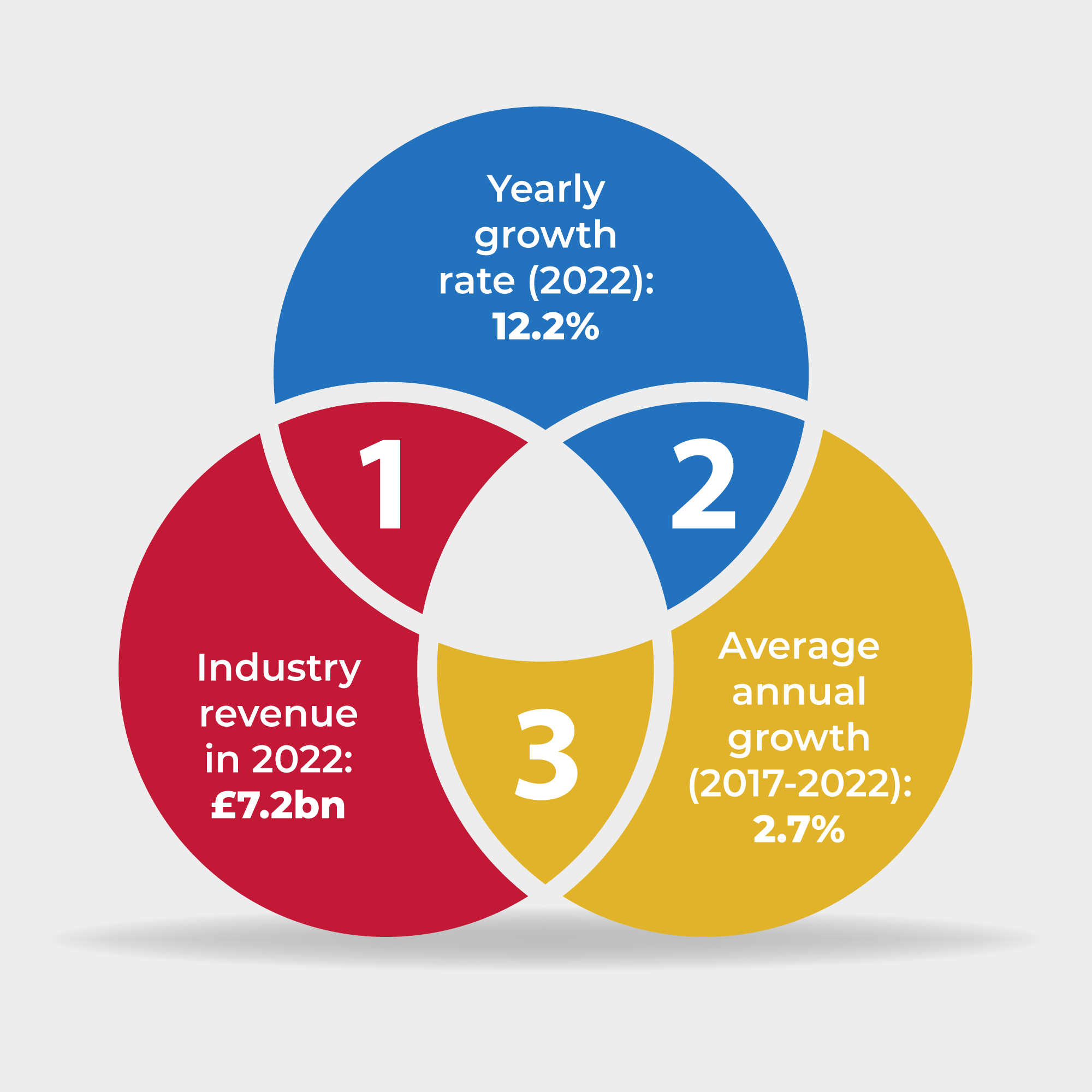

In 2022, the accounting & auditing industry made £7.2bn. That's a 12.2% increase from before. From 2017 to 2022, this industry in the UK grew by 2.7% each year.

Learning the fundamentals of accounting is really important for business owners and those just starting.

This blog is part of our guide on accounting. It explains why accounting matters, helps you learn the fundamentals of accounting and how accounting courses in the UK can help you achieve your goals. Let's dive in!

What is accounting?

To get a grip on the fundamentals of accounting, you need to know what accounting means.

Accounting is all about organising a company's financial transactions in a structured manner. It includes keeping records, filing reports and processing and analysing financial transactions when needed. Accounting is essential for legal and tax reasons and to judge how well a business is doing. Every business transaction is accounted for. So, if you ever need information about expenses, it's easy to find.

|

|

There are eight main types of accounting: |

|

1. Financial accounting |

This kind of accounting makes sure transactions are shown properly in financial documents like income statements. These statements are shared with people outside the business. |

|

2. Management accounting |

This type of accounting makes financial information available to the management team. They use this information, such as budget details, to make important decisions in order to keep the business running smoothly. It’s an internal process that helps improve the overall business. |

|

3. Cost accounting |

This falls under the umbrella of management accounting, focusing on a company's expenses related to running its operations. It considers different costs such as fixed and variable costs, covering aspects like rent for business space, expenses for materials and the costs associated with labour. |

|

4. Tax accounting |

This is an accounting system primarily concerned with taxes. Instead of creating public financial statements, it focuses on preparing tax returns, analysing them and presenting tax payments accurately. |

|

5. Auditing |

Auditing offers an independent analysis of a company's financial activity. Its objective tracking and reporting systems ensure the business complies with applicable rules and best standards. Audits can be internal or external. Internal audits aim to assess the efficiency of a company's accounting methods, by identifying potential resource wastage and minimising the risk of fraud. They are necessary for the improvement of financial planning. External audits review a company's official financial statements to confirm their compliance with Generally Accepted Accounting Principles (GAAP). |

|

6. Forensic accounting |

This system investigates inconsistencies and fraudulent actions, using a mix of auditing, accounting and investigative expertise to scrutinise and understand business data. Forensic accountants are often used in legal cases to investigate fraudulent behaviour. Their services are extensively relied upon by accounting firms, law firms, banks, government agencies and insurance companies. |

|

7. Governmental accounting |

This type of accounting focuses on the financial activities of government bodies. Its main purpose is to guarantee transparency and responsibility in the management of public funds. |

|

8. International accounting |

As companies grow internationally, they encounter various accounting standards and methods which are unique to each country. Additionally, they need to consider currency exchange variations and global tax matters. International accounting deals specifically with applying specific accounting standards to a company's finances abroad. Activities include monitoring tax regulations and accounting principles that impact business transactions or activities. |

Accounting courses in the UK can help you gain an in-depth understanding of the different types of accounting.

What are the fundamentals of accounting?

There are five important fundamentals of accounting. These are the revenue recognition principles, cost principles, matching principles, full disclosure principles and objectivity principles.

Let's learn the fundamentals of accounting #1: Revenue recognition principle

This principle states that businesses should record their revenue at the time it is created. This is crucial because it shows the real financial situation of the company. This helps stakeholders make better decisions. Also, it ensures that companies follow the rules of GAAP and stay within legal boundaries.

Fundamentals of accounting: Common terminologies used and their definitions

- Accounting period – a specific time frame used to record financial transactions and prepare financial statements. It could be every month, quarter, or year, depending on when the accounting period starts and ends. At the end of this period, the accountant or bookkeeper prepares financial reports. This helps the business see how well it's doing, keep an eye on investments and plan ahead.

- Revenue – the money a business makes from sales during an accounting period. To calculate it, the business costs are subtracted from the total revenue.

- Financial position – also known as the balance sheet. This is a statement that shows what a business owns (assets), what it owes (liabilities), the money it's made (income) and the overall value of the business (equity).

- GAAP – the sets of guidelines that help businesses prepare and present financial statements. GAAP follows a method called double-entry accounting to ensure that reports like income statements, balance sheets, debts and expenses are completed correctly.

- Double entry accounting – a way of recording financial information: what is coming in (debit) and what’s going out (credit). Recording two entries for every transaction helps figure out profits and losses correctly.

- Income statement – a financial statement that shows a business’s income, expenses and profits earned during an accounting period. It reveals how well a business is doing and where it can improve.

- Balance sheet – a financial statement that shows business assets, liabilities and how much the company is worth (equity). It helps assess the financial stability of the business and its overall financial health.

- Debt – the amount that a business is obligated to pay back. It could be owed from a loan or a credit card. Not paying it back on time can have consequences.

- Expenses – the costs of running a business. Expenses include advertising, rent, electricity, paying employees and business insurance. Fixed expenses (like rent) stay the same, while variable expenses are those that change, depending on how much business is completed.

- Profit and loss statements – measure how profitable a business is. This is calculated by subtracting all expenses from the total revenue of the business.

Want to know more about the above terminologies? Pursue accounting courses in the UK and stay ahead of the industry.

Let's learn the fundamentals of accounting #2: Cost principle

The cost principle states that when a business deals with a financial transaction, it should be recorded at the original price. This cost is set when the transaction is completed which does not change even with the changing circumstances. This principle applies to all business assets, like land or equipment. A record is kept of a business’s tangible assets, without considering market value or depreciation. Following the cost principle requires the business to record its assets and liabilities and makes this simple to do.

It also gives solid proof of transactions, like sales receipts, invoices and bank reconciliation, making the financial position clear and accurate.

Fundamentals of accounting: Common terminologies used and their definitions

- Tangible assets – are physical items that a business owns and can be used as collateral or exchanged for products and services. Tangible assets include cash, stocks, property, office equipment, bonds, furniture, etc.

- Intangible assets – are assets a business owns with no physical form. They include items like ideas (intellectual property) and financing.

- Market value – the estimated value of an asset or property on the open market. For example, it helps to know how much a business's shares in the stock market are worth.

- Bank reconciliation – the process of checking if bank statements and financial records match up. This helps make sure all transactions are written down correctly.

Pursue accounting courses in the UK from a reputed higher education institution and understand more about the basics of accounting.

Let's learn the fundamentals of accounting #3: Matching principle

The matching principle states that the expenses a business disburses should be recorded at the same time as the revenue generated. This means expenses should be recorded in the same period as the associated revenue and not at the time they are billed. This principle ensures that profits are shown accurately and truly reflect the real performance of the business. It also prevents expenses from being represented as being higher in one accounting period to offset revenue from a previous accounting period.

Fundamentals of accounting: Common terminologies used and their definitions

- Net income – what's left after deducting all business expenses from total income during a certain accounting period. This is used to assess the health of a business, using ratios like return on assets, return on equity and price-to-earnings.

- Return on assets ratio – a measure of how well a business is utilising its assets to generate income. This is calculated by dividing the net income by everything a business owns (assets). It helps compare the business with others in the same field.

- Return on equity ratio – shows how profitable a business is by dividing the net income by shareholder’s equity and is represented as a percentage. A higher ratio means a more profitable business.

- Shareholder’s equity – the portion of a business's assets that belongs to its shareholders. It's what's left after deducting everything the business owes from what it owns. To figure it out, deduct all the business's liabilities from its total assets and then divide by the total number of common shares.

- Common shares – the ownership of a business where the holder owns a portion of a company’s profits and assets.

- Preferred shares – the ownership of a company where the holder has a fixed dividend rate of profit before others who have common stock.

- Price-to-earnings ratio – also known as the P/E ratio. It compares how much a share in a company costs compared to how much it earns. It is calculated by dividing the current market price of shares by the earnings per share (EPS). The P/E ratio helps investors understand if a stock is worth more or less than it should be.

- Earnings per share – showcases a business’s financial performance. It is calculated by dividing the total earnings of the business by the outstanding number of stocks there are. This measurement helps investors compare businesses of varying sizes.

If you want to gain a deeper understanding of the fundamentals of accounting, pursue accounting courses in the UK. GBS offers “BSc (Hons) Accounting & Financial Management” for students who want to build a successful career in accounting and financial management.

Let's learn the fundamentals of accounting #4: Full disclosure principle

The full disclosure principle in accounting states that important financial information must be shared with all stakeholders and owners, regardless of the nature of the information. This information must be disclosed accurately and on time. It includes details about assets, income, liabilities, expenses and other important financial indicators. This information may be reflected in public company filings, inventory valuation, or depreciation.

But when it comes to internally generated financial statements, this principle doesn't always apply. It's assumed that the management already has full knowledge of the business. Also, a business might choose to share only the information that affects the financial position of the business.

Fundamentals of accounting: Common terminologies used and their definitions

- Public company filings – official documents that businesses have to submit. They usually include reports that tell how the business is doing every quarter and every year.

- Inventory valuation – how businesses figure out the market value of their inventory. They do this by giving each item in their inventory a monetary value based on what it costs to purchase or produce.

- Depreciation – how businesses spread the cost of assets over their lifetime. For instance, when a business purchases a new car, it can note down the value that the car loses every year based on its depreciation.

Study accounting courses in the UK to learn the fundamentals of accounting and make a strong foundation for your career ahead in the industry.

Let's learn the fundamentals of accounting #5: Objectivity principle

The objectivity principle in accounting states that financial statements should be prepared based on objective evidence and only show the facts. Following this principle ensures that the statements are correct, fair and free from bias. This prevents an accountant or bookkeeper from changing financial statements based on what they estimate or on rumours. If there are any changes made to the statement, they need to clearly document those changes. This is a fundamental principle of GAAP.

Fundamentals of accounting: Common terminologies used and their definitions

- Objective evidence – evidence that's based on real facts and can be verified independently.

- Subjective evidence – evidence based on opinion which can't be validated.

How can you become an accountant?

If you're interested in becoming an accountant and learning the fundamentals of accounting, it's recommended to get some form of formal education like pursuing accounting courses in the UK. A proper education covers everything you need to know. Self-study or working as an assistant to an accountant might leave some knowledge gaps and make it hard to do the job well.

At GBS, you can pursue an accounting course in the UK, BSc (Hons) Accounting & Financial Management.

Pursue an accounting course in the UK with Global Banking School (GBS)

GBS is a leading higher education institution in the UK known for its industry-specific courses in areas such as finance, business, education, healthcare and more. With a wide presence in the major cities of the UK, the institution is dedicated to its mission of “changing lives through education.”

BSc (Hons) Accounting & Financial Management

The BSc (Hons) Accounting & Financial Management degree is a four-year course that includes a foundation year. You can take this course at different GBS campuses such as in London, Birmingham, Leeds and Manchester.

Whether you're aiming for a career in accounting and financial management or dreaming of starting your own business, understanding numbers is crucial for success. This accounting course in the UK teaches you the latest principles, theories and practical skills in the exciting field of accounting and financial management.

This degree in accounting and financial management provides you with the essential knowledge and skills needed for a successful career that aligns with your goals.

Frequently asked questions about the fundamentals of accounting

The five fundamentals of accounting are:

- Revenue recognition principles

- Cost principles

- Matching principles

- Full disclosure principles

- Objectivity principles

Simply put, fundamental accounting keeps track of cash movements and business activities. It categorises all transactions into debits and credits.

In accounting, liability refers to any financial obligation a business owes to an individual or another business by the end of an accounting period. These obligations are cleared by transferring economic assets like money, goods, or services.

Italian, Luca Pacioli is recognised as the pioneer of modern accounting. In 1494, he detailed the double-entry bookkeeping method employed by Venetian merchants in his work, Summa de Arithmetica, Geometria, Proportioni et Proportionalita. Although not the originator of the method, Pacioli was the first to articulate the concept of debits and credits in journals and ledgers, forming the foundation of contemporary accounting systems that we use today.

Learning the fundamentals of accounting is essential for all finance experts as it provides a valuable understanding of profits, operations, expansion and the fundamental factors driving the business. You can gain a deep knowledge of accounting by pursuing an accounting course in the UK with GBS. Its BSc (Hons) Accounting & Financial Management degree can help you achieve your dream of succeeding in the industry.

Explore our courses

Choose from a wide range of vocational, foundation, undergraduate and postgraduate courses in Finance, Business Management, Healthcare, Tourism and more…