A beginner’s guide on international accounting standards

The field of finance is evolving quickly. Just when you feel like you've mastered everything and become the financial expert you aimed to be, a new aspect is introduced. This means that learning and progress in this field are both ongoing and never-ending.

International Financial Reporting Standards (IFRS), created by the International Accounting Standards Board (IASB), is gaining more importance in finance. Many countries are changing their laws continuously to align with IFRS. This shift has led to a growing number of professionals learning international accounting standards.

IFRS consists of a set of rules for accounting. These standards determine how various transactions should be documented in financial statements. IFRS is followed by over 100 countries, including those in the G20 and the European Union. By using IFRS, companies can make their financial statements comparable to those of companies worldwide.

If your career goal is to become an expert in international accounting standards, you're in the right place. This comprehensive guide will bring you one step closer to achieving your ambitions.

What are the international accounting standards?

Table of Contents

- What are the international accounting standards?

- What is IFRS?

- History of IFRS

- What is the difference between IFRS and GAAP?

- Why should you learn about international accounting standards?

- What are the skills required to become an IFRS expert?

- Want to gain accounting skills in the UK?

- Frequently asked questions about international accounting standards

The International Accounting Standards (IAS) are a set of guidelines established by the IASB. These guidelines aim to simplify the process of comparing financial reporting and data for businesses worldwide. They enhance transparency and trust in the accounting process, especially in the context of investment and global trade.

Having an international accounting standard also eases compliance pressures and can substantially lower reporting-related costs. This is particularly beneficial for companies with international operations and subsidiaries in various countries, as it streamlines reporting and practices.

It's essential to note, however, that IAS has been replaced by the newer IFRS.

What is IFRS?

IFRS (International Financial Reporting Standards) represents the global accounting framework. It provides a standardised set of rules to ensure that financial statements are uniform, transparent and comparable worldwide. The issuance of IFRS is the responsibility of the IASB, a recognised organisation that provides guidelines to companies on how to manage and report their accounts.

IFRS outlines the approach for defining various transactions and important events related to a company's financial operations. One of the main advantages of IFRS is that it instils confidence in investors, whether they are from the same country or different countries, enabling them to make well-informed decisions.

There are various IFRS standards that you need to pay attention to. Here are some areas where IFRS provides detailed regulations:

- Statement of financial position: Commonly known as a balance sheet, IFRS outlines the different components and how they should be reported.

- Statement of comprehensive income: This can be presented either as a single statement or as a combination of a profit and loss statement and a statement of other income.

- Statement of changes in equity: Sometimes termed as a statement of retained earnings, this document should record the changes in profits for your business during a specific financial period.

- Statement of cash flow: This document should offer a summary of your business's financial transactions over a given period, categorising cash flow into financing, operations and investing.

|

|

Features of IFRS |

|

Uniformity |

Ensures consistent reporting guidelines globally, facilitating easy comparison of financial statements worldwide without applying different accounting principles. |

|

Accuracy |

Promotes accuracy and consistency in reported financial data, aiding in better business decision-making. |

|

Benefits new and small investors |

Common financial standards simplify reporting, providing better quality and levelling the playing field for new and small investors against established corporates. They also face lower risk from corporates taking advantage. |

|

Consistency |

The uniform structure of financial documents created using IFRS leads to consistent and easily understandable documents. |

|

Commencement of lease term |

Specifies the date from which a lessee is entitled to exercise the right to use a leased asset, referring to the date of initial recognition of the lease. |

|

Resource management |

Streamlined accounting standards through IFRS enable companies to manage resources efficiently and may reduce the cost of auditing and statutory reporting. |

|

Lowered cost of capital |

Standardised financial reports under IFRS allow businesses to raise capital from foreign markets at lower rates, instilling confidence in investors and making financial reporting more understandable internationally. |

History of IFRS

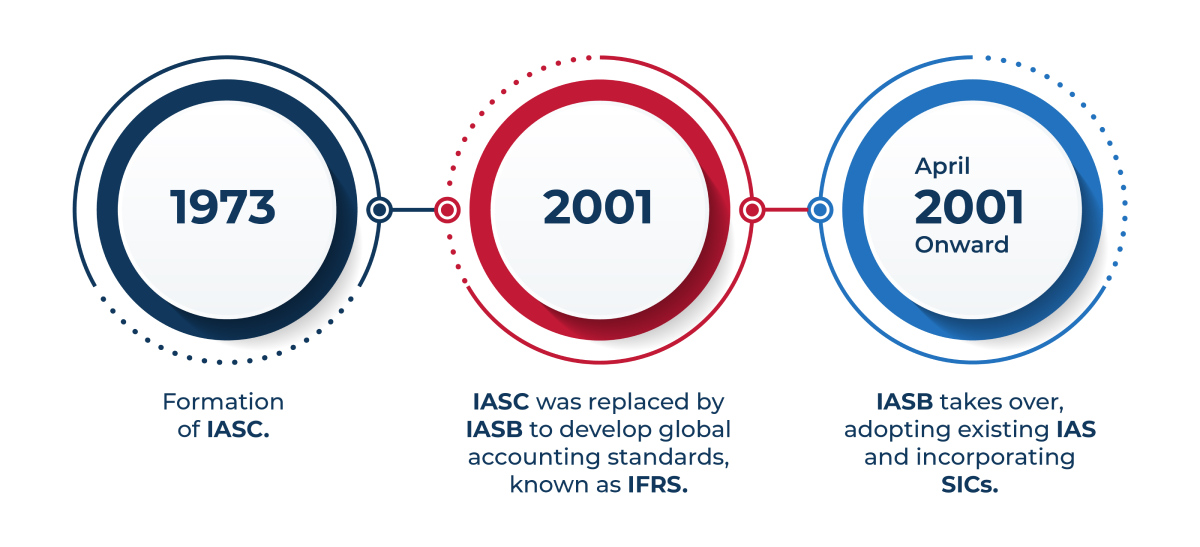

The formation of IFRS was driven by the idea that having consistent accounting standards ensures uniformity. The International Accounting Standards Committee (IASC) was established in 1973 by active accountancy bodies in ten countries. This organisation published a conceptual framework known as international accounting standards.

In 2001, the IASC was replaced by the IASB. The goal behind developing these global accounting standards with IFRS was to bring consistency to accounting standards worldwide. IFRS originated in the European Union and due to its popularity, it quickly gained acceptance globally.

Originally known as International Accounting Standards, IFRS was issued by IASC between 1973 and 2001. From April 2001 onward, IASB took over from IASC and its new board agreed with existing IAS and adopted Standing Interpretations Committee standards (SICs).

What is the difference between IFRS and GAAP?

The regulations overseeing financial reporting rules may differ from one country to another. In over 100 countries worldwide, accounting standards are structured within the IFRS framework.

What sets GAAP and IFRS apart? Let’s have a look at the table below:

|

Parameter |

GAAP |

IFRS |

|

Objectives of financial statements |

Sets distinct objectives for business and non-business entities. |

Adopts a single objective for all entity types. |

|

Presentation of earnings |

Highlights consistent earnings results across years. |

Not explicitly specified. |

|

Documents |

Mandates financial statements to encompass a balance sheet, income statement, changes in equity, cash flow statement and footnotes. |

Requires financial statements to comprise a balance sheet, income statement, changes in equity, cash flow statement and footnotes. |

|

Disclosure |

Demands companies to disclose information about accounting choices and expenses in footnotes. |

Not explicitly addressed. |

|

Intangibles |

Recognises acquired intangible assets at fair value. |

Recognises intangibles only if they bring future economic benefit and possess measured reliability. |

|

Accounting for assets |

Defines an asset as a future economic benefit. |

Views an asset as a resource expected to generate economic benefit. |

|

Fixed assets |

Values fixed assets using the cost model. |

Permits an alternative model – the revaluation model. |

|

Underlying assumptions |

Not specifically stated |

Assigns greater significance to underlying assumptions such as accrual and going concern. |

Why should you learn about international accounting standards?

Acquiring knowledge of accounting standards, particularly IFRS, offers several advantages, especially for those aspiring to pursue a career as a finance manager. Here are compelling reasons to consider studying IFRS:

- High demand for skilled professionals: There is a shortage of accounting experts with an in-depth knowledge of international standards within the industry. Expertise in IFRS can position you favourably for opportunities with leading organisations.

- Increased opportunities and attractive salaries: With the widespread implementation of IFRS in many countries, the demand for skilled professionals is expected to surge in the coming years. Studying IFRS can open doors to lucrative career prospects, accompanied by attractive salary packages.

- Relevance across financial and banking sectors: The financial industry is constantly in need of IFRS professionals to implement these standards in financial reporting. A proper qualification in IFRS enhances your potential for career advancement, promotions, or securing a higher position within these sectors.

- Venturing into financial education: Possessing knowledge of IFRS allows you to achieve a successful career in the financial education sector. You can join educational institutions as a subject matter expert, contributing to training programmes focused on IFRS.

What are the skills required to become an IFRS expert?

If aspiring to become an IFRS expert is your career goal, there are certain skills crucial to develop while studying international accounting standards. Some key skills essential for this career path include:

- Comprehensive understanding of accounting and financial reporting

- Staying current with evolving reporting standards

- A strong memory to retain rules and regulations

- Aptitude for quickly grasping new enhancements

- Capability to find effective ways to implement recent changes

Want to gain accounting skills in the UK?

If you want to learn the fundamentals of accounting skills in the UK, Global Banking School (GBS) can help you do so. GBS is one of the leading higher education institutions in the UK, known for its industry-specific courses in fields such as accounting, healthcare, business and more. With a wide presence in major cities of the UK, the institution is dedicated to its mission of “changing lives through education”.

GBS offers an accounting course in the UK for students who wish to achieve great success in the world of accounting and finance.

Accounting course in the UK by GBS

GBS offers a BSc (Hons) Accounting & Financial Management. It’s a 4-year course, including a foundation year, offered at different GBS campuses in London, Birmingham, Leeds and Manchester.

Whether your goal is to pursue a career in accounting or financial management or to establish and manage your own successful business, a strong grasp of numbers is crucial for success. This accounting course in the UK provides you with the fundamental knowledge of the latest principles, theories and applied practical skills in the dynamic field of accounting and financial management.

This accounting course in the UK will provide you with the in-demand skills that employers seek, creating possibilities for career advancement and growth. By blending theoretical understanding with practical expertise, you will gain knowledge in various areas of accountancy and finance. These encompass:

- Financial reporting

- Managerial accounting

- Audit and assurance

- Taxation

- Law

- Corporate finance

Want to know more about this accounting course in the UK? Contact our student support team now!

Frequently asked questions about international accounting standards

International accounting standards, established by the IASB, are a set of principles to facilitate straightforward comparisons of financial reporting and data for businesses globally. This initiative enhances transparency and fosters trust in the accounting process, particularly in the world of investment and global trade.

The main difference between IAS and IFRS is their timing. IAS is the older version of accounting standards and IFRS is the newer and widely accepted version worldwide. IFRS has more detailed rules for reporting finances and covers a wider range of accounting issues compared to IAS.

GAAP stands for Generally Accepted Accounting Practice. It is a set of standardised accounting rules and procedures used in the United States for financial reporting.

IFRS is applied in over 100 countries globally, including the European Union and numerous countries in Asia and South America. In contrast, GAAP is exclusive to the United States.

GBS offers one of the best accounting courses in the UK for students who wish to achieve career success in the accounting sector. BSc (Hons) Accounting & Financial Management offered by GBS helps you gain transferable skills that can be utilised in any career. Contact us to enrol in our accounting course in the UK.

Explore our courses

Choose from a wide range of vocational, foundation, undergraduate and postgraduate courses in Finance, Business Management, Healthcare, Tourism and more…